After Middlebury took a financial hit due to the pandemic, the Board of Trustees met in the last week of January to establish a plan for financial stability.

The Board of Trustees established three main conditions the institution must fulfill to achieve financial stability: operating at a surplus by fiscal year 2022, growing the endowment and paying off half of the institution's outstanding debts.

To achieve those goals, the board increased tuition and fees by 2.5%, limited the endowment draw to 5% and instructed the administration to begin making principal payments on half of the institution's outstanding debt.

Middlebury will not make any decisions about extending or ending the wage and hiring freezes until May.

Generating a surplus

Middlebury has operated at a budgetary deficit since 2012. When the board appointed President Laurie Patton in 2016, they established the “Road to a Sustainable Future,” a plan to break even on the budget by FY21. Middlebury was on track to achieve that goal by FY21 before the pandemic arrived, but instead closed out FY20 with a $11.6 million dollar deficit due to the pandemic.

Middlebury initially projected a $18.5 million deficit for fiscal year 2021 — which stretches from July 2019 to July 2020 — but the latest projection estimates a $10.2 million deficit instead. Middlebury experienced worse-than-expected losses from the shuttered schools abroad and a lack of revenue from room and board fees for remote students. However, unexpected “federal and state support for Covid-19 related costs and lost revenues” decreased operating costs and better performances by the summer Language Schools and the Monterey Institute made a significant difference, Executive Vice President for Finance and Administration David Provost said in an email to The Campus.

Despite recent losses, the board decided to resume the effort to balance the budget in the January meeting. They instructed the institution to produce a small surplus by 2022 and operate at a surplus of at least 1% by FY23, or $2.6 million.

A major part of balancing the budget relies on the college raising tuition. Though the college’s 3.25% tuition hike for the 2020-2021 academic year was met with staunch protest from students, parents, faculty and staff, the board decided to raise tuition and fees by another 2.5% for the upcoming year. Students will pay a total of $76,820 — $59,330 in tuition, $17,050 for room and board, and a $440 student activities fee.

But tuition increases alone will not close the budgetary gap, at least as the college defines it.

The college has defined the deficit based on the total revenues, which include the annual amount drawn from the endowment. If the college kept the draw on the endowment to a consistent figure closer to the endowment’s actual rate of growth — between 6 and 7% on average — instead of limiting the draw to 5%, the college may well be operating at a surplus instead, according to Professor of Economics Peter Matthews, who serves as co-chair of the the Middlebury chapter of the American Association of University Professors (AAUP) Finance Committee and as a member of its Executive Committee.

A hard cap on the endowment draw artificially limits the resources available, a decision that may force the college to make unnecessary cuts and sacrifices in the future, according to Matthews.

“It's one thing to say that the sacrifice is absolutely essential to the well-functioning of the institution,” Matthews said. “But I am at the least incredibly uncomfortable with sacrifice on the altar of some arbitrary definition of deficit and surplus.”

Limiting the endowment draw

Between July 1 and Dec. 31, 2020 — the start of FY21 and the end of calendar year 2020 — the endowment grew by more than 15.4%, a $170.21 million increase. The institution is still awaiting information on the fourth-quarter returns, but Provost estimates that growth may actually exceed 16% or even 17%, making it the largest growth in more than a decade and more than twice the rate of growth in 2019. As of Feb. 2, Provost estimated that the total value of the endowment exceeded $1.25 billion.

The annual endowment draw is calculated based on a rolling average of the endowment balance for the previous three calendar years. The 5% Middlebury will draw for FY22 will come from the mean size of the endowment over 2018, 2019 and 2020 as of Dec. 31 2020. This strategy ensures that an individual year’s spike or decrease does not cause massive fluctuations in the amount of the draw, according to Provost.

Middlebury increased the endowment draw to 7.5% in FY21 in response to the pandemic, but the board elected to limit the endowment draw to 5% for FY22 and beyond. Middlebury assumes that the endowment will grow an average of 6 or 7% annually over a 10 year period. A 5% draw would therefore allow the endowment to grow by 1 or 2% each year, according to Provost.

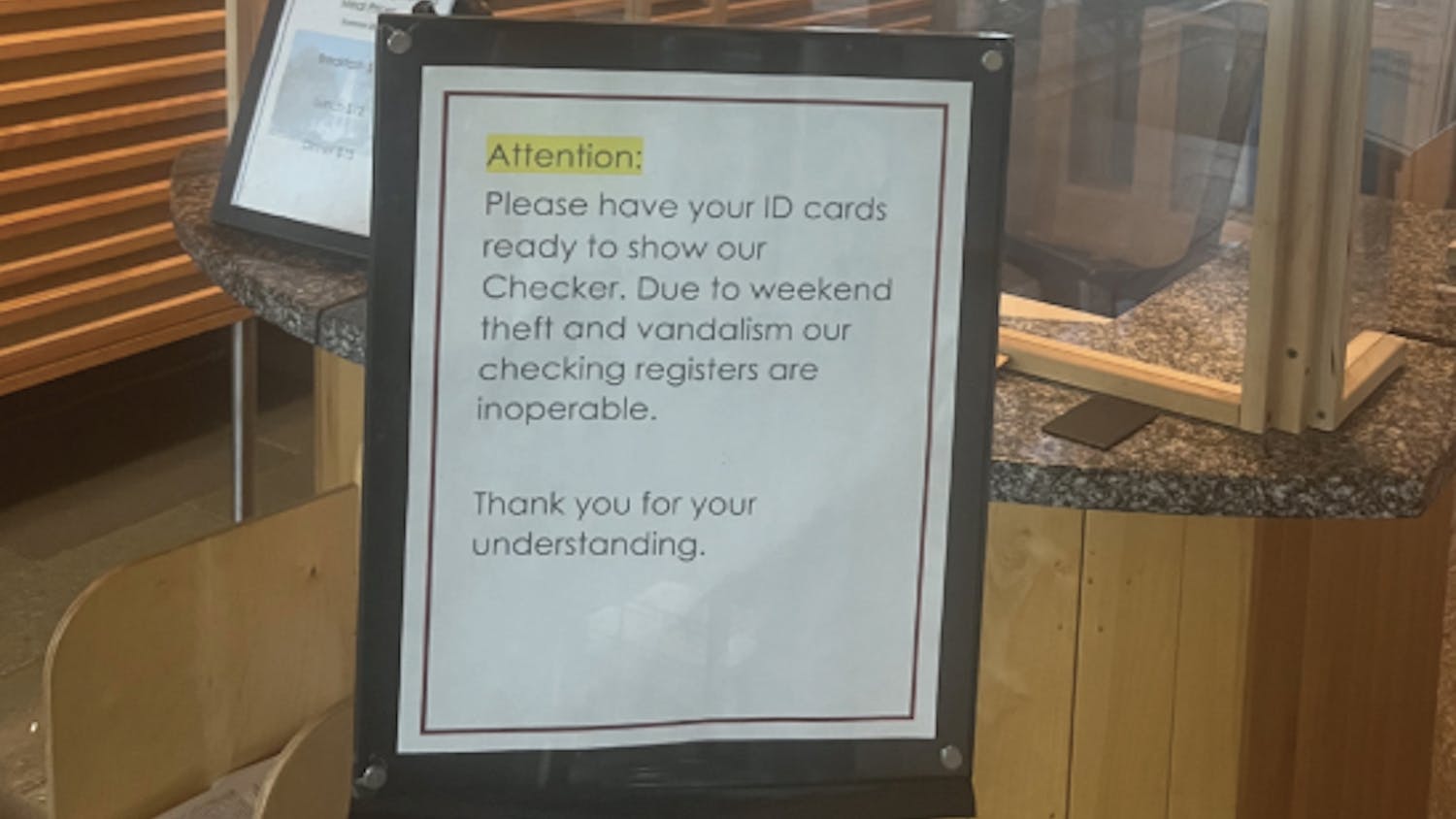

Financial mismanagement by the previous administration ate through the institution's unrestricted reserves — the portion of the endowment not earmarked for specific purposes or programs by either donors or the board — which currently amount to just $4.7 million. Provost said the institution has to grow the endowment so it will be prepared for the next “rainy day” after the pandemic ends.

“The endowment is a multi-generational investment tool to support multiple generations of students and programs,” Provost said in an email to The Campus. “It is not a bank account, and we cannot use it to solve the dilemma of the college living beyond its means for the last decade nor solve the short-term strains of the pandemic.”

But Matthews questions why Middlebury is trying to grow the endowment for a future rainy day while the institution is currently in the midst of a crisis.

“It's important that we preserve a Middlebury for the next generation that is at least as good as the one that you're enjoying,” Matthews said. “But it works in both directions. [Current students are] entitled to a Middlebury that is at least as good as the Middlebury that future generations are going to enjoy.”

The AAUP advocated for an annual endowment draw of at least 7% in a statement published in May of 2020. A draw of that size would keep pace with the endowment’s average yearly growth. While the endowment would not grow, it also wouldn't shrink, fulfilling what Matthews views as the extent of the institution’s duties to future generations at this current moment.

“Especially during the period of Covid, [limiting the endowment draw to] five or even 6% effectively punishes this generation [for the sake] of future generations,” Matthews said. “[Current students are] one of the generations that count when we talk about intergenerational equity.”

Repaying debt

Rather than increase the endowment draw, the Board of Trustees during their summer meeting authorized the institution to borrow up to $30 million over the next five to seven years to make up for budget shortfalls. The institution will decide on how much money they will borrow in April or May, according to Provost.

Provost estimates that the loans will have interest rates between 1.75% and 2.25%. However, the real interest rate — what the institution will actually have to pay back after adjusting for inflation, typically around 2% — may very well be negative, meaning that the institution would pay less than they originally borrowed, according to Matthews.

“If one needs to borrow in order to cover shortfalls, this is not a bad time to do so,” Matthews said.

Even as the institution is proposing taking out more loans, the board’s latest plans prioritize paying back its current $268,093,000 debt. Rather than continue to pay only interest and defer payments on the principal of the loan, Middlebury amortized half of the outstanding debt, meaning the institution will make principal payments of $5 million to $13 million annually over the next ten years.

Provost believes that continuing to refinance the loans, even given current financial hardships, would not be “fiduciarily responsible” and unfairly punish future generations.

“With interest rates so low, some would argue that we should push out debt and not pay back the debt, just keep rolling it over,” Provost said in an email to The Campus. Instead, Provost advocates for paying back debt taken on to acquire assets as they are being used. This way, future generations are not burdened with the responsibility to pay for amenities that previous generations enjoyed.

The board also authorized renovations to Warner and Voter Halls as well as Dana Auditorium in Sunderland Hall in their January meeting. Construction is set to begin this summer and is projected to cost $10.8 million. The majority of those funds come from 2010 bonds, which have to be used within 36 months of the date the institution refinanced them last year.

The decision to focus on paying back debts and continuing with large-scale infrastructure renovations directly contradicts the AAUP’s call to “prioritize people before buildings and debt retirement” in their May 2020 statement.

“It is people, not capital assets, that define the Middlebury community, and funds otherwise set aside for infrastructure or accelerated debt repayment should be diverted in a crisis,” the statement said.

Middlebury has yet to make any decisions about many of the people-oriented issues the AAUP referred to in their priorities — including lifting the hiring freeze, adjusting faculty and staff compensation and ending or extending wage continuity. Provost said such decisions will come in May, when the institution does its normal budgetary planning for the coming fiscal year.

Moving forward

The Board of Trustees’ announcement came as “a complete surprise” to faculty, according to Matthews. Not only were they not consulted or part of the decision making process at all, faculty were not even informed that these decisions were being made.

Matthews views these financial decisions as central to the values Middlebury prioritizes, values which he says the entire Middlebury community — faculty, staff and students included — should be a part of determining.

“We still need a conversation about what our common goals are and what kind of financial practices would allow us to achieve those goals that aren't unilateral and don't presuppose some assumptions about the way financial markets work that's completely untethered from reality,” Matthews said.

The AAUP will meet in March to discuss the Board of Trustees’ announcement and to develop a formal response.

Sophia McDermott-Hughes ’23.5 (they/them) is an editor at large.

They previously served as a news editor and senior news writer.

McDermott-Hughes is a joint Arabic and anthropology and Arabic major.

Over the summer, they worked as a general assignment reporter at Morocco World News, the main English-language paper in Morocco.

In the summer of 2021 they reported for statewide digital newspaper VTDigger, focusing on issues relating to migrant workers and immigration.

In 2018 and 2019, McDermott-Hughes worked as a reporter on the Since Parkland Project, a partnership with the Trace and the Miami Herald, which chronicled the lives of the more than 1,200 children killed by gun violence in the United States in the year since the Marjory Stoneman Douglas High School shooting in Florida.